Android Phone Fans |

- T-Mobile Samsung Galaxy Note 2 Leaked For $300 At Walmart

- Official Google Play Twitter Page Confirms Verizon Wireless Carrier Billing Coming To Play Store

- Unofficial Galaxy Nexus Google+ Page Mentions Multiple Nexus Devices – Android Fans Go Nuts

- Google’s influence on Motorola’s hardware won’t be evident until late next year

- Google misses Q3 earnings expectations, suffers major blow in stock

- Acer Iconia Tab A110 coming to North America October 30th for $230

- Starbucks update brings Holo UI and My Starbucks Rewards

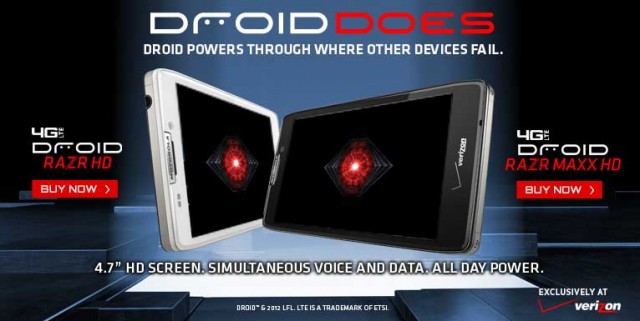

- Motorola DROID RAZR HD and RAZR MAXX HD now available from Verizon

- New Casio G’zOne phone on the way, shows up at FCC

- Apple loses UK appeal, must place ads saying Samsung is no copycat

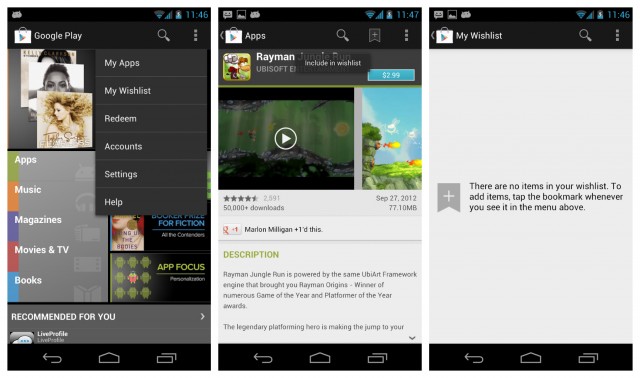

- Just In Time For Christmas, Wishlists Arrive In The Google Play Store

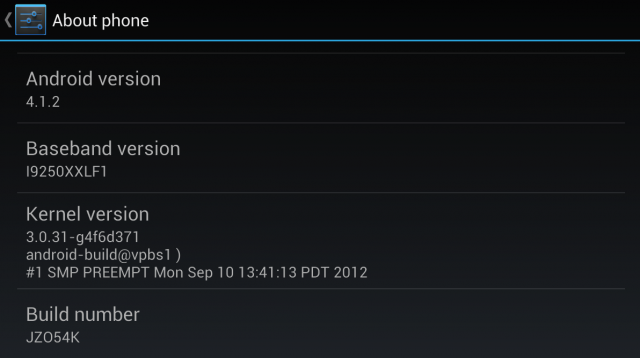

- Android 4.1.2 Over-The-Air Update Now Rolling Out To Google Play Galaxy Nexus (Takju)

| T-Mobile Samsung Galaxy Note 2 Leaked For $300 At Walmart Posted: 18 Oct 2012 06:46 PM PDT With little more than a vague “in the coming months” launch window for the T-Mobile Galaxy Note 2, we’ve all been left wondering, not only exactly when we can pick up the phoneblet, but how many pennies that darn thing is going to cost us. Well, if you’re looking for the on-contract pricing for the G-Note 2, the boys over at TMoNews were able to secure some leaked pricing information for not only the upcoming tablet, but the LG Optimus L9 (the real device you’ve been waiting for). According to the leak, the Samsung Galaxy Note 2 for T-Mobile could launch at a whopping $300, with the L9 coming in at just under a buck. With Walmart being the “low price leader,” we can only pray the price tag wont go up when sold directly at T-Mobile retail stores. I also have a feeling we’ll be looking at some kind of mail-in rebates so expect the out-of-pocket price to be even higher. Of course, none of this is confirmed, and we’ll let you know when we learn of something a little more official. In the meantime, have you guys been saving up for big bubba? Or will you opt for the smaller, more petite figure of the Nexus 4? |

| Official Google Play Twitter Page Confirms Verizon Wireless Carrier Billing Coming To Play Store Posted: 18 Oct 2012 06:05 PM PDT Good news for those that don’t like all the hassle that comes with purchasing apps from the Google Play Store using one of those boring old credit cards. The official Google Play Twitter confirmed today that carrier billing will be finally be making its way to Verizon Wireless. That means Verizon customers will soon find themselves joining illustrious group of Sprint and T-Mobile’s elite customers who’ve been enjoying the many benefits of throwing apps directly on top of their already high monthly cellphone bill. I understand that this is a great option for those without poor or no credit, but honestly — how many people actually take advantage of it? Either way, options are good and with Android, we have plenty of them. |

| Unofficial Galaxy Nexus Google+ Page Mentions Multiple Nexus Devices – Android Fans Go Nuts Posted: 18 Oct 2012 05:51 PM PDT Careful out there, folks. I know we’re all a bit excited, scouring the nets for any bit of info regarding the next Nexus device(s) but just like the world of Twitter, Google+ is full of unofficial accounts spreading hope (sometimes falsely). Take the “Galaxy Nexus” Google+ account which posted the following:

This lead our Phantips inbox filling with, “ERMAHGERD!!! NERCKSERZ!!!!!” emails from excited Android-fanboys across the globe. Only one problem — the Galaxy Nexus Google+ page in question ISN’T OFFICIAL. Whoever runs it was merely commenting on current rumors and speculation that multiple Nexus devices could be announced on October 29th. We’ll still keep our fingers crossed but in the meantime, watch yourself out there. The net is a big strange place (especially those weird kids on Google+). [Google+] |

| Google’s influence on Motorola’s hardware won’t be evident until late next year Posted: 18 Oct 2012 03:00 PM PDT In the financial conference call Google held today, Google CEO Patrick Pichette talked about the Google-Motorola marriage and what it meant for the future of Motorola’s product line. He first reminded folks that in the 150 days since the acquisition, Google has “harmonized” and scaled back Motorola’s product line (which we believe means less crap and better quality), pulled out of several different markets, undertook the streamlining of software, and more. That last bit would seem true already as the new versions of MotoBlur are as close to vanilla Android as they’ve ever been. And while Google originally shied away from questions of its plans for Motorola by saying they’d continue to operate as they always have, Pichette kind-of sort-of confirmed that Google would be doing more to influence Motorola’s product line in the future. He was quick to remind everyone that product cycles take time. From the beginning of R&D to a retail launch takes 12-18 months on average, which means if Google has a hand in the development of new Motorola devices its impact wouldn’t be made evident until sometime in Q4 of next year at the earliest. He also wanted to cool down the panic mode that seems to have swept the news wire as the company suffered a major stock hit after missing expectations for the quarter. Pichette says the Google-Motorola story has only just begun, and while we’re not promised a fairy tale ending just yet we can surely expect an exciting plot as it thickens. Before we get out of hand we need to remember one thing — this does not automatically entitle us to a Motorola-made Nexus device (at least not right away). While droves of us would love for that to happen Google’s making it clear that other OEMs will still get fair shots at making Nexus devices. How long that stance might last remains to be seen, but I can tell you one thing: many of us wouldn’t mind having Motorola make Nexus devices for years to come. |

| Google misses Q3 earnings expectations, suffers major blow in stock Posted: 18 Oct 2012 02:12 PM PDT

Google’s Q3 financial call isn’t until later today, but preliminary earnings details were made public earlier today. Google expected to post $10.65 earnings per share and rake in $11.86 billion, but instead finished just shy of that. Instead, the company posted $9.03 per share and only brought in $11.33 billion. The margins don’t look significant but when your company is selling upwards of $700 and maintains a $230 billion market cap it doesn’t make for good times around the Mountain View offices. Google’s performance knocked its share price down about 9% at one point, though that number is now sitting at 8.01% as of the closing of the market today. That number is good to knock off $60.49 per share as of the time of closing, and that brings them to right around $695. After-hours trading doesn’t seem to indicate Google will recover much of that by the time the market opens tomorrow morning, though it’s always tough to say where they’ll be 24 hours from now. A number of things contributed to this unfortunate fall, the most interesting of which being Motorola Mobility’s operating loss of $151 million out of revenues of $2.58 billion on the quarter. The full numbers can be found in the press summary below. It wasn’t long ago that things were looking up for Google. The company had surpassed Microsoft in market cap for the first time and many expected Google to dominate that #2 position after a brief period of ebb and flow. Google ended up dropping back down to about $227 billion while Microsoft is still sitting around the $248 billion they had when Google first reached the milestone. While Android isn’t everything (well, for us it is… but not in the grand scheme of it all), it’ll be interesting to see how this upcoming New York City event on October 29th or any other happenings will affect Google’s stock. Google is rumored to be revealing Android 4.2 and the next Nexus phone that day, and while it may not impact Google’s fortunes much the announcements should hopefully be a little bit of an espresso shot for its stock. Even if Motorola didn’t post any losses it wouldn’t have helped Google much in terms of reaching expectations so you have to wonder whether or not Google will attribute losses to the growing pains of this new relationship. We won’t get those thoughts until the conference call takes place later today, but don’t expect any buses waiting on the pavement (at least not in any obvious way). It’ll be an interesting call to sit in on, that’s for sure. How much do you think this loss hurts Google in the long run?

|

| Acer Iconia Tab A110 coming to North America October 30th for $230 Posted: 18 Oct 2012 09:44 AM PDT As much as we talk about the Nexus 7 and Amazon Kindle Fire it can be easy to forget that Acer is also trying to break into the affordable tablet games. Acer has actually been doing it for quite some time, but it seems these new devices have pressured the OEM to introduce its tablets at more attractive price points. Acer’s pricing has never been too bad relatively speaking, but having even more affordable products only makes us more excited. Acer’s latest 7-inch wonder — the Acer Iconia Tab A110 — looks to make some waves when it comes to North America October 30th. The tablet, which will cost $230, runs Android 4.1 Jelly Bean out of the box and gives you ample power with 1GB of RAM and NVIDIA’s quad-core Tegra 3 processor. You’ll get 8GB of internal storage, but unlike some of these other affordable tablets you’ll also get the option of expanding your storage by up to 32GB via a microSD card slot — kudos, Acer! Unfortunately it seems Acer wasn’t in position to take a loss on the tablet like Google and Amazon, and had to cut corners in a couple of different places. For starters, the display is not full HD. Instead you’ll be getting a 1024×600 configuration. It’s a tad disconcerting knowing that my smartphone has a higher screen resolution than my tablet, but my smartphone also costs $600 off contract so perhaps I should be too surprised. We still have some pretty nice features to sweeten the deal, though, including a micro HDMI port. It will all come down to whether or not you can get jiggy with that display — if you can’t, and if none of the added connectivity options are a concern for you, then there are other mouth-watering options that will cost you even less. Look for these to be available at retailers like Best Buy and Amazon when it ships at the end of this month. |

| Starbucks update brings Holo UI and My Starbucks Rewards Posted: 18 Oct 2012 08:19 AM PDT

When apps get updated to conform to Android’s new design guidelines I always get a little giddy inside. After all, consistency is key and everyone knows that’s one of the main problems with the collection of apps currently available in the Google Play Store. While I’m no java nut I was happy to see that Starbucks updated its application to bring the Holo UI into the mix. You’ll get swiping action, the action bar, crisp controls and a more smooth experience to feed your unhealthy addiction, but that’s not all we’re getting in this update. Starbucks has also brought the ability to view your My Starbucks Rewards information to see how close you are to getting that next quad half caf venti 3 pump vanilla 3 pump hazelnut soy extra hot no foam with whip and cinnamon sprinkles latte. Aside from all of that, general performance improvements and bug fixes have made their way into this delicious package. And you still retain the ability to locate your nearest shop on a map and reload your Starbucks card. The app is visually rich so all the resources inside make up for a seemingly steep 6.1MB download, but you coffee fiends are likely to justify the download even if you had absolutely no space or bandwidth to accommodate it. Get your download in the Google Play Store. |

| Motorola DROID RAZR HD and RAZR MAXX HD now available from Verizon Posted: 18 Oct 2012 07:28 AM PDT While the Motorola DROID RAZR M is a fine device for many different people it’s no secret that our readership has instead been looking forward to the RAZR HD devices to make their way to Verizon Wireless. Fortunately the devices are indeed available, and you can get them for $200 (RAZR HD) and $300 (RAZR MAXX HD) by opening your wallets and heading to VerizonWireless.com or your local Verizon store. These devices are follow-ups to the successful RAZR reboot of yesteryear, and while an upgrade for those of you who got those phones might not seem ideal there’s plenty reason for you to consider them just as strongly as anyone. The devices have a 4.7 inch HD display, an 8 megapixel camera, a 1.5GHz dual-core S4 processor, 1GB of RAM, Android 4.0, NFC, and more. The two variants have a slight difference, of course, as the MAXX HD comes outfitted with a 3,300mAh battery rated for 32 hours. Verizon and Motorola aren’t saying that’s talk time, mind you, so we imagine they went with average smartphone usage tests to determine that number. It’s still very impressive whichever way you look at it, and we’re sure many people will spring for that version because of it. The RAZR HD’s battery isn’t all that bad, though, as it houses a battery with a capacity around 2,500 mAh. This should still deliver some very solid battery life considering the S4 processor is known to handle power management very well. Those wanting a developer edition of the Motorola DROID RAZR HD can go here, but there’s an unfortunate twist for those seeking the MAXX HD variant — there won’t be a developer’s edition. This means you’ll have to deal with a tough cookie of an encrypted bootloader and support for custom ROMs will be very limited. If the bootloader means nothing to you then get over to Verizon Wireless to stake your claim to the other two. You can also do yourself a favor and check our hands-on time with the MAXX HD by clicking right here. [via Verizon Wireless | RAZR HD, RAZR MAXX HD, RAZR HD Developer Edition] |

| New Casio G’zOne phone on the way, shows up at FCC Posted: 18 Oct 2012 07:23 AM PDT

Verizon’s Casio G’zOne Commando wasn’t exactly the phone of the year, but for what it was — a ruggedized Android device with a fair bit of power — you couldn’t ask for much more. So we’re more than intrigued by a recent FCC filing that reveals a followup to the handset, a new Gz’One-branded handset listed as the Casio C811. The new Gz’One phone looks to continue the tradition of combining a rugged exterior with a properly-specced smartphone, and upgrades the previous model with such features as Verizon LTE connectivity and NFC. It also carrier GSM worldphone, which could come in handy for your next globe-trotting spelunking excursion. There is no word on exactly what spec the phone carries in terms of resistance to shock/heat/water/dust/etc., but we assume it will at least match that of previous Gz’One handsets. From the sketch accompanying the FCC documents, the aesthetics of the device look to remain the same, at least. We haven’t heard anything from inside Verizon to suggest a possible launch date for the handset, but given that the phone is already making a trip to the FCC it could hit shelves by the end of the year. [via Engadget] |

| Apple loses UK appeal, must place ads saying Samsung is no copycat Posted: 18 Oct 2012 06:13 AM PDT Apple just lost one appeal they certainly were hoping to have reversed. A panel of judges in the UK has upheld an earlier ruling that Samsung’s Galaxy Tab did not copy the design of Apple’s iPad. You might recall that at the time of the initial ruling, a judge made the backhanded statement that Samsung’s tablet was not as “cool” as Apple’s. You might also recall the punishment handed down, which ordered Apple to post notice on their website and in several publications explicitly stating that Samsung did not copy their designs.

The judges said that such an “acknowledgement must come from the horse’s mouth,” adding, “Nothing short of that will be sure to do the job completely.” The ruling could still be appealed to the UK Supreme Court, but it currently appears as though Apple has no plans to do so. The results of the case could have much larger implications, as the ruling is valid throughout Europe and could prevent Apple from taking further legal action against Samsung based on this particular design claim. The decision contrasts recent developments in the US, where Apple won a $1 billion dollar settlement after bringing similar patent and design infringement claims in front of a California courtroom. Samsung said of the ruling, “We continue to believe that Apple was not the first to design a tablet with a rectangular shape and rounded corners. Should Apple continue to make excessive legal claims in other countries based on such generic designs, innovation in the industry could be harmed and consumer choice unduly limited.” Apple had not comment. [via BBC] |

| Just In Time For Christmas, Wishlists Arrive In The Google Play Store Posted: 17 Oct 2012 09:06 PM PDT After laying dormant for weeks now, Google has finally flipped the switch enabling the bookmarking of apps, music, movies, and books in the Play Store. This is a “feature” I’ve been clamoring for since the dawn of the Android Market (I have an app addiction, one that needs to be sorted), and comes as a welcomed update. Well, the wait is officially over and while you can’t share your Wishlists with friends and family just yet, it is a nice place to tuck away apps you would maybe wanna try out later, or save for until after the Christmas season (once you’ve accumulated enough Google Play Store giftcards from relatives). There’s no need to hunt or look for an updated version of the Play Store, it’s already there. You just need to wait for Google to enable it in the current version, 3.9.16. Let’s hope Google has more goodies in store for the Play Store hopefully revealing more at their October 29th press event in NYC. It’s a good time to be alive and reppin’ the green robot, folks. Let us know if you see Wishlists in your Play Store yet. Thanks, Ricky! |

| Android 4.1.2 Over-The-Air Update Now Rolling Out To Google Play Galaxy Nexus (Takju) Posted: 17 Oct 2012 08:52 PM PDT That didn’t take long. After the international model of the Galaxy Nexus began receiving its over-the-air update to Android 4.1.2 a few days ago, now those that purchased the device in the Google Play Store can get in on some of the fun as well. We’ve received quite a few Phantips, alerting us that the OTA update is now live, so if you haven’t yet been prompted, jump into your Settings app and pull it manually. If it’s still not there, you can either sit tight, or manually download the update (but only if you’re running JRO03, and you know exactly what you’re doing). The update can be grabbed via Google’s server here. As for the rest of us, we’ll just be hanging out, wishing we knew what it was like to have the absolute latest version of Jelly Bean. (Sigh). Thanks, ToxMarz, Flyingsolow, Forrest, and Justin! |

| You are subscribed to email updates from Android Phone Fans To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment